How Paul B Insurance can Save You Time, Stress, and Money.

Wiki Article

What Does Paul B Insurance Mean?

Can not acquire or use different additional protection (like Medigap). You should have both Part An and Part B to join a Medicare Advantage Plan. When you have Medicare as well as various other health and wellness insurance (like from your job), one will certainly pay very first (called a "key payer") as well as the other 2nd (called a "secondary payer").

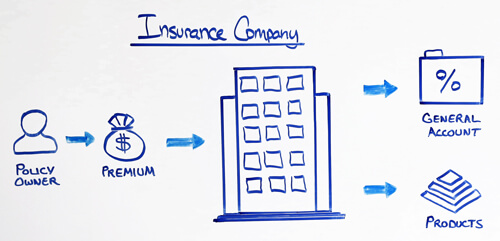

Life insurance policy is an arrangement in between you (the insurance holder) and also an insurance provider that pays out if you die while the policy is in pressure. The goal is to provide a monetary safety and security internet, so your household or enjoyed ones won't have to fret about paying expenses, last costs, or various other financial obligations in the absence of your income.

After you pass away, your beneficiaries may then use the survivor benefit payment to cover all kinds of costs or financial debt, including: End-of-life costs as well as funeral expensesEstate preparation expenses, Regular monthly bills and also home loan repayments, Child treatment as well as college tuition, Medical expenses, Various other economic commitments Many life insurance coverage companies do not cover fatality by suicide within the first 2 years the policy is in force.

The Only Guide to Paul B Insurance

We don't sell your information to 3rd parties. Term, whole, global, variable, and final cost insurance are the five main sorts of life insurance coverage plans on the marketplace though there are several added subtypes. Term life insurance is among the most prominent and budget friendly kinds of insurance policy. It's an uncomplicated plan that lasts for a certain variety of years commonly 10 to 30.

49% of the sandwich generation do not live insurance policy, A current Policygenius study located that 49% of the sandwich generation (individuals with a parent age 65 or older who additionally are raising youngsters or supporting grown-up kids) does not have life insurance to assist economically support their liked ones after they pass away.

Life insurance rates go up anywhere from 4. 5% to 9% every year we age, since we all end up being riskier to insure as we grow older. Your gender, Since females commonly live longer than men, covering females presents much less near-term danger to an insurance coverage company. Consequently, women pay a standard of 24% less forever insurance coverage than men.

Top Guidelines Of Paul B Insurance

The insurer, the insurance holder, the survivor benefit, and also the recipients are some of the main elements of a life insurance plan. Below Find Out More you'll locate a full list of the components of a life policy and what they mean. These terms can help you comprehend your life insurance policy plan as you're reviewing via it.

The insurance policy holder, The insurance policy holder is the owner of the life insurance coverage plan. The insurance policy holder pays the costs and also preserves the plan.

find hereWhen they pass away, the life insurance company pays the survivor benefit. The survivor benefit, The death advantage is the quantity of cash the beneficiaries get if/when the insured dies. It's most commonly paid as a tax-free round figure. The beneficiaries, The beneficiaries are individuals that obtain the fatality advantage when the insured dies.

How Paul B Insurance can Save You Time, Stress, and Money.

The plan size, The plan length refers to how long the policy will certainly be active. Irreversible policies last your whole life many grant, or mature, at age 100.

The cash worth, The cash money value is an attribute that comes with numerous irreversible life insurance policy plans it supplies a separate account within your plan that makes passion at a fixed rate. The longer you have actually been paying into your plan, the greater your money worth will be. The motorcyclists, Cyclists are optional attachments you can use to personalize your plan.

With other riders you'll pay added as an example the kid rider, which features an added, smaller sized survivor benefit to cover your children in situation they die. You must pick a recipient who's economically connected to you, or who you can depend receive the survivor benefit on your behalf.

click to read more

The Of Paul B Insurance

If your kids are minors, you can additionally list a relative who would certainly be their guardian in your absence. Policygenius advises utilizing estate preparation tools like counts on to guarantee the money is used the way you desire it to be made use of. The majority of costs can be paid on a monthly or yearly basis.

Some business will allow you to pay with a credit history card for repeating payments, but this is much less usual as well as it depends on the insurance company. Your recipients will need to accumulate vital records such as the fatality certificate and also the existing life insurance coverage plan papers.

:max_bytes(150000):strip_icc()/how-does-health-insurance-work-f7aa9125e51f4f6698b38789ff3929c3.png)

Beneficiaries can select to get the survivor benefit in a number of different forms, most generally in a swelling sum or installments. When you obtain the benefit in a round figure, it'll be tax-free. Selecting to get the advantage in installations is additionally tax-free, although you'll pay earnings tax obligation on any rate of interest acquired by the staying sum of cash held by the insurance coverage company.

Paul B Insurance Things To Know Before You Get This

Is life insurance an excellent investment? Life insurance policy functions as an economic safety and security net for your enjoyed ones as a primary objective. Permanent life insurance policy products do have an investment component, yet it's best to talk to a financial consultant given that there are other typical investment methods that are less high-risk and also usually produce greater returns.

Sharing, or pooling, of risk is the main principle of business of insurance coverage. The suggestion has the elegance of simplicity integrated with functionality. If riskschances of losscan be separated amongst many members of a group, then they need fall however lightly on any type of solitary participant of the team. Hence, tragedies that could be crushing to one can be made manageable for all.

The suggestion, as well as the method, of risk-sharing come from antiquity. Thousands of years have expired given that Chinese vendors developed an ingenious method of shielding themselves against the chance of a financially crippling distress in the treacherous river rapids along their trade courses. They simply divided their freights amongst several watercrafts.

What Does Paul B Insurance Do?

Each stood to shed only a tiny portion. They might not have considered their scheme as insurance, however the principle is incredibly similar to that of its modern-day counterpart, sea marine insurance, along with to that of various other kinds of property and also casualty insurance policy. With modem insurance coverage, however, rather than literally dispersing freights amongst a number of ships, sellers as well as shipowners find it easier to spread the financial prices of any losses amongst numerous sellers as well as shipowners via using monetary arrangements.

Report this wiki page